capital gains tax budget news

Capital Gains Tax. For example if you spent 310000 on buying a house years ago and sold it for 500000 today then your capital gains would be 190000 and youd have to.

State Taxes On Capital Gains Center On Budget And Policy Priorities

Capital gains in excess of Rs.

. If the property is sold after 2 years changed in Budget 2017 and applicable from April 1 2017 of purchase the corresponding gains or losses is called LONG Term Capital Gains or Loss. In calculating the gain arising from the residential property disposal taxpayers can take into account their annual exemption which the government confirmed will remain 12300 for individuals up to and including the 2025-26 tax year and any allowable capital losses arising prior to the disposal including brought forward losses from. The net investment income tax can add an additional 38 tax on top of your capital gains tax if your modified adjusted gross income MAGI is above 200000 for single filers or 250000 for.

CGT event is the date you sell or dispose of an asset. 1 lakh per annum. Any profit or gain that arises from the sale of a capital asset is a capital gain.

Short Term Vs Long Term Capital Gains. And for an SMSF the tax rate is 15 and the discount is 333 rather than 50 for individuals. What is Capital Gains Tax.

Short-term capital gains are taxed at your ordinary income tax rate. A concessional rate of tax 10 will be leviable on the long-term capital gains Q3 Tax is liable to be paid in excess of how much amount of capital gains. 50000 - 20000 30000 long-term capital gains.

The CGT on 1270 would be 419 You can also deduct any trading costs from any profits. Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates. Compliance checks series factsheet updated to include budget.

This capital gain is subject to a tax called Capital Gains Tax CGT which is currently charged at a rate of 33 in Ireland. 0 15 and 20. If you have more than 3000 in capital losses this excess amount can be carried forward to future years to similarly offset capital gains or other income in those years.

Long Term capital gains from property is taxed at flat rate of 20 after. What is Capital Gains Account Scheme. This means that no tax is required to be paid on capital gains upto Rs100000.

In addition to federal taxes on capital gains most states levy income taxes that apply to capital gains. Long-term capital gains are taxed at only three rates. If capital losses exceed capital gains you may be able to use the loss to offset up to 3000 of other income.

Sandeep bought 250 shares of a listed company in October 2014 at a cost of Rs. There are two main categories for capital gains. Information about Schedule D Form 1040 or 1040-SR Capital Gains and Losses including recent updates related forms and instructions on how to file.

Capital Gains Tax was introduced on 1 October 2001. The 1990 and 1993 budget acts increased ordinary tax rates but re-established a lower rate of 28 for long-term gains though effective tax rates sometimes exceeded 28 because of. It comes about most often for taxpayers when their home or investment property is sold for a profit gain ie.

This means long-term capital gains in the United States can face up to a top marginal rate of 371 percent. Hi Andrew Thanks for your comment. The depreciation claimed on capital works will reduce the cost base adding to the capital gain.

Remember this isnt for the tax return you file in 2022 but rather any gains you incur from January 1 2022 to December 31 2022. 100000 are liable to tax. As mentioned above the time limit available to the depositor for re-investment and avail the exemption in many cases is longer than the due date to file the return of income.

Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts. The base cost is the purchase. It forms part of normal income tax and is based on the sliding tax tables for individuals.

Their combined income places them in the 20 tax bracket. Cost of purchase multiplied by CII of the year of sale divided by CII of the year of purchase Let us tweak the above example a bit to illustrate long-term capital gains. If sold within 2 years its SHORT Term Capital gains or loss.

145 per share paying a total of Rs. However if the asset is owned by a company the company is not entitled to any CGT discount and youll pay a 30 tax on any net capital gains. What is a Capital Gains Tax event.

In Ireland the first 1270 of taxable gains in a tax year are exempt from CGT. At the state level income taxes on capital gains vary from 0 percent to 133 percent. If the property appreciated to 620000 when John sells he would pay tax on 20000 at favorable capital gains rate since inherited property is considered long-term property Rosen says.

As a married couple filing jointly they were able to exclude 500000 of the capital gains leaving 200000 subject to capital gains tax. Economists have long taken issue with the 50 per cent capital gains tax discount which allows wealthier investors to flip properties at a profit without hefty tax bills and costs the federal. Capital gains tax is a tax you pay to the government when you make a profit by selling your investment property or something else of value for more than you originally paid for it.

Use Schedule D to report sales exchanges or some involuntary conversions of capital assets certain capital gain distributions and nonbusiness bad debts. However if the property is sold and you have owned the property for greater than 12 months only 50 of the capital gain will be added to your assessable income. The formula to check the indexed purchase price of the asset is.

As per Budget 2018 long-term capital gains on the sale of equity shares units of equity oriented fund realised after 31st March 2018 will remain exempt up to Rs. Moreover tax at 10 will be levied. Limit on the Deduction and Carryover of Losses If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately or your total.

Capital Gains Tax and Annual Tax on Enveloped Dwellings returns on time CCFS18a. The proceedsselling price is more than the base cost. Capital Gains Account Scheme was introduced in 1988 by the Central Government.

News stories speeches letters and notices.

The Long And Short Of Capitals Gains Tax

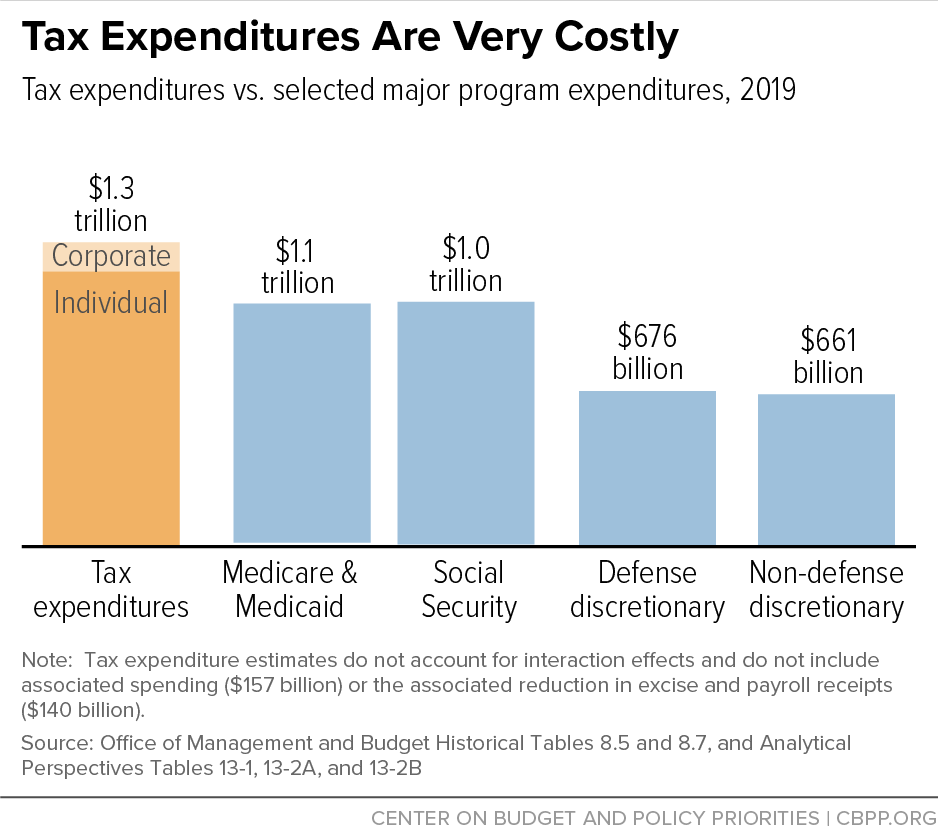

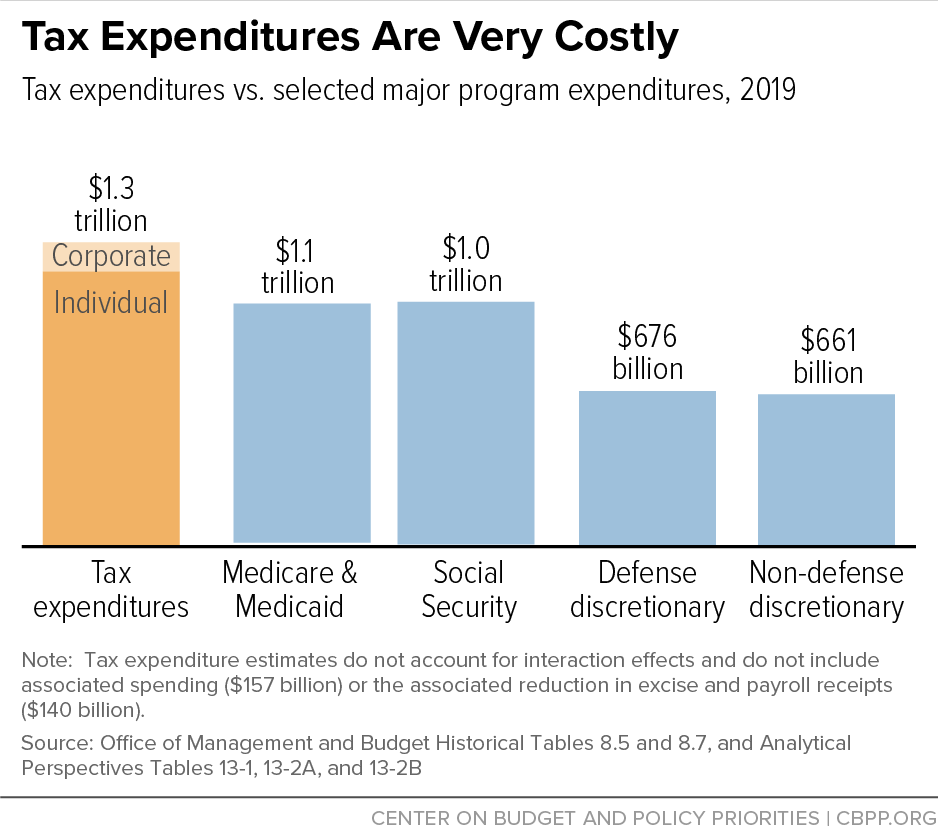

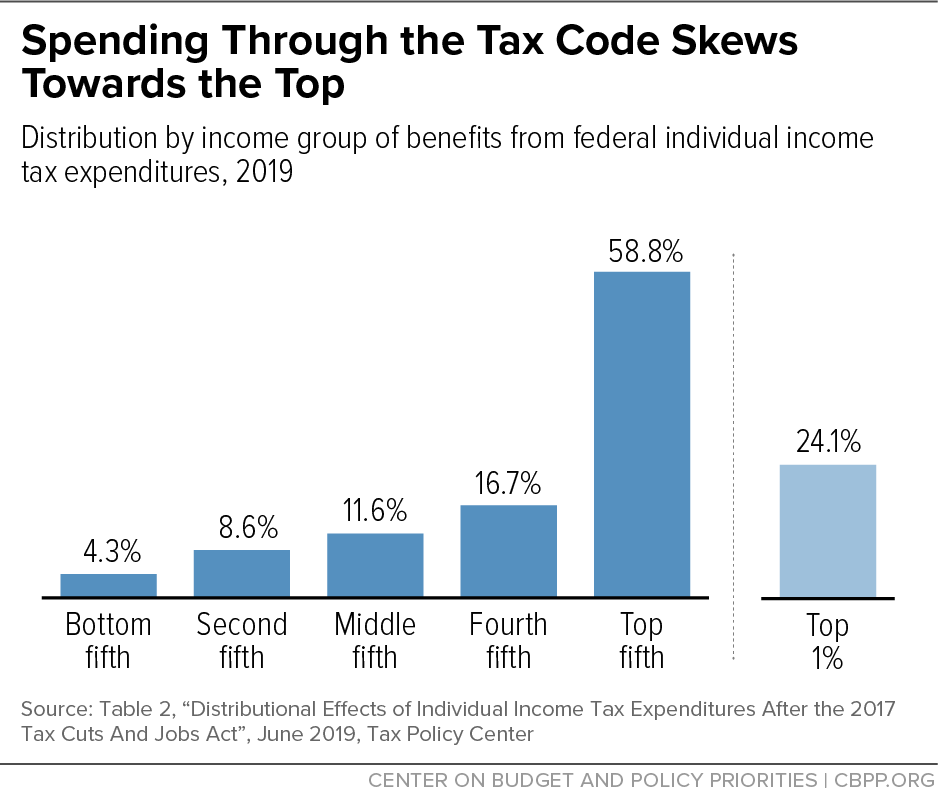

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

How To Save Capital Gains Tax On Property Sale 99acres

With Unexpectedly High State Revenues Youngkin Calls For More Tax Relief Virginia Mercury

State Taxes On Capital Gains Center On Budget And Policy Priorities

State Taxes On Capital Gains Center On Budget And Policy Priorities

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

How To Save Capital Gain Tax On Sale Of Residential Property

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

Biden S Better Plan To Tax The Rich Wsj

The Case For A Robust Attack On The Tax Gap U S Department Of The Treasury

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

What Is Short Term Capital Gains Tax Stcg Tax Budget News Short Term Capital Gains Tax Definition

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

Biden Budget Biden Tax Increases Details Analysis

Income Tax Slabs To Change In Budget 2020 Some Countries With No Income Tax

The Long And Short Of Capitals Gains Tax

Tax Drag What A Drag It Is Getting Taxed Physician On Fire Tax Financial News Practice Management

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities